Safety tips for the Holiday Season

Don't let the rush and excitement of the holiday season make you careless. Let's make this season especially cheerful by ensuring the protection of our loved ones and valuables. Make sure decorations are not only put up beautifully but safely as well. If you have recently bought a new home, take the time to consider safety hazards or potential vulnerabilities. The following tips can help you be

more careful, prepared and aware during the holiday season. |

| Keep any large displays of gifts out of sight |

Securing your home this season: preventing burglary

The Holidays are a particularly vulnerable time for families and their home security. With the increase of purchasing and storing of desirable goods, burglars find this time particularly appealing. But home invasion can be easily prevented. Keep windows, garages and sheds locked and don't forget to use deadbolts, even if you are just stepping out for a few minutes. Don't leave a spare key in a "hiding place." It's safe to say that if you put it somewhere that helps you remember where it is, it is probably somewhere others will easily guess. Lock your power box with an electricity authority lock (only you and the electric company have a key) so that your home security alarm system can't be cut off from the power supply.Avoid drawing attention to your home by keeping any large displays of holiday gifts not be visible through the windows and doors of your home. You can discourage a lot of robbers by making your home appear "active" Use timers to turn on lights and a television or radio. Indoor and outdoor lights should be on an automatic timer. Think of it as the "Home Alone" method of home protection. When leaving home for an extended time, have a neighbor or family member watch your house and pick up your newspapers and mail.

|

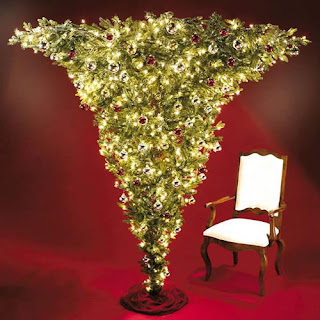

| Make sure your Christmas tree is mounted on a sturdy base. |

Hazard Free Decoration Placement: Ways of avoiding tripping, fire, and other safety issues

Placing the tree and other holiday decorations should not only be based on the lighting and Feng shui. Safety should be factored in as well. When setting up a Christmas tree or other holiday display, make sure doors and passageways are clear. Be sure your Christmas tree is mounted on a sturdy base so children, elderly persons or family pets cannot pull it over on themselves. Delicate or dangerous ornaments (such as swallowing hazards or glass) should be placed higher up on the tree away from little hands or doggies. Maintain at least a foot of space between a burning candle and anything that can catch fire. Try to keep electrical elements plugged in near an outlet, draping cords across rooms can be a very dangerous tripping hazard. |

| Don't overload electric circuits with Holiday Lights |

Fire Safety for all the lights, candles, wires, and highly flammable elements of the Holidays:

The Holidays can have quite the assortment of fire hazard possibilities. Materials such as dry pine trees and wrapping paper are highly flammable and surrounded by potentially fire producing sources. It's simple to make sure that all of our decorations and presents don't go up in smoke. When hanging lights outdoors, avoid using staples or nails which can damage wiring. Use UL-rated clips or wires instead. Each year check your string of lights on your Christmas tree to ensure the wiring is not damaged or frayed. Frayed or damaged wiring can cause a fire. Don't overload electric circuits with holiday lighting. Spread out the various electrical needs of your decorations to various outlets if possible. Always unplug lights before going to bed including your glittering tree. Place your Christmas tree in water or wet sand to keep it green and more flame retardant. Never place wrapping paper in your fireplace. It is not only enrionmentally unsafe but can contain toxins including lead!This season while you check your Xmas "to-dos" off your list, keep track of safety as well. Make sure your home is always secure and appears "active". Place decorations aways from open flames and out of walkways. Check all of your wiring for frays and keep your tree quenched! And remember if all you want for christmas this year is a new home, Ricardo The Realtor and his team are here for you. We can find you homes in the Long Beach area for the same prices as renting. Our team will stay with you every step of the way and direct you to invaluable resources to help you have the best home purchasing experience.